31 January 2025 Israel makes legislative changes affecting private companies - Effective as of 1 January 2025, closely held companies may be subject to ITO Section 81 provisions (addressing undistributed accumulated profits), and ITO Section 62A provisions (addressing the taxation of current earnings of these profits).

- The legislation in question is considered complex in its practical application, and uncertainties and gaps remain regarding how the provisions of the law should be implemented.

| |

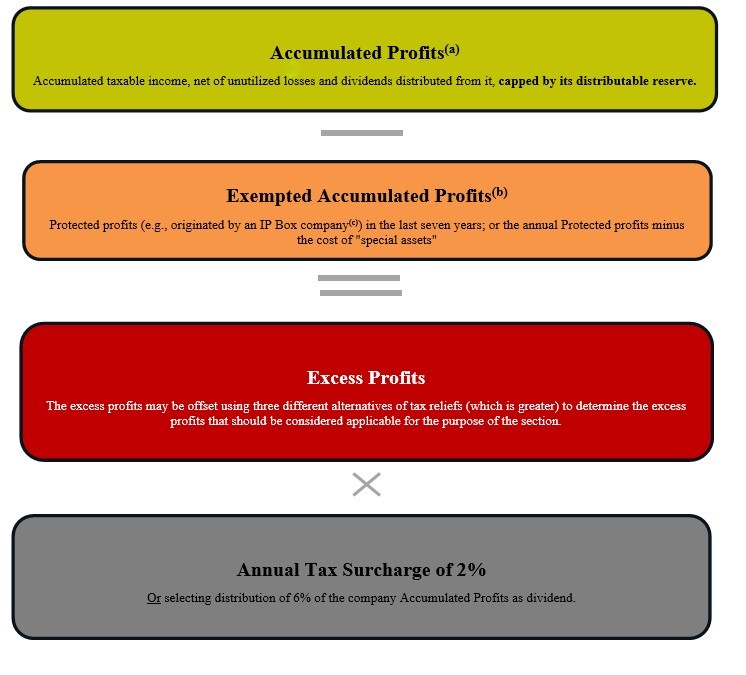

Due to two changes made under the Economic Efficiency Act that the Knesset approved in early January 2025, companies that fall within the definition of "closely held company" (CHC) may be subject to tax on undistributed accumulated profits and on current earnings of these profits. This Alert outlines the fundamental and general principles of the legislative changes and notes aspects that remain open to interpretation and debate. Section 81 - Taxation of undistributed profits Section 7 of the Israeli Tax Ordinance (ITO) defines a closely held company (CHC) as "a company that is controlled by five person or fewer,1 is not a subsidiary,2 and is not a company in which the public has a significant interest."3 Under legislative changes to ITO Section 81, CHCs will be required, effective 1 January 2025, to determine which of the following alternatives to apply with respect to their accumulated profits: - A 2% annual tax surcharge on undistributed profits classified as "bad surpluses" (which cannot be offset against other taxes)

- A dividend distribution totaling 6% of its accumulated profits (or 5% if distributed during 2025 only)

The CHC's choice in one year is not binding on the next year — it may choose different alternatives each respective year.4 The sequence of actions for complying with the provisions of the law is as follows: - Assess whether the company in question meets the definition of a CHC (in particular the "significant public interest" test). If not, the ITO Section 81 provisions should not apply.

- If the entity is considered a CHC, assess whether any of the following conditions apply and thus exempt the CHC from the additional 2% tax for the year in question:

- The company's current losses (business or capital) exceed 10% of its accumulated profits.

- The CHC has distributed a dividend exceeding 50% of the last year's Excess Profits (defined based on the equation below).

- The CHC has followed a dividend distribution alternative (i.e., 6% dividend distribution from the companies accumulated profits).

- There are no Excess Profits (based on the calculation below).

- To the extent the CHC does not qualify under numbers 1 though 3, above, the CHC's "Excess Profits" must be calculated as follows:

- "Accumulated Profits" — The total taxable income of the company, plus the income exempt from tax, including capital gains as defined in Section 6 of the Property Taxation Law, accumulated from the date of its incorporation until the end of the specified tax year, minus the tax levied on it and minus any dividends it distributed until the end of the specified tax year, and minus any losses incurred by the company that were not offset, capped by its distributable reserve.

- "Exempted Accumulated Profits" — Profits originate from: income of a preferred/approved/technology enterprise; income from an industrial enterprise; income from the company's building operations that are subject to the provisions of ITO Section 8A(c) in its calculation; and income of a financial institution from its operations as a financial institution. These profits will be calculated according to one of two alternatives: (1) Exempted Accumulated Profits in the last seven years; or (2) Exempted Accumulated Profits minus the cost of "special assets" (securities, intangible assets primarily generating royalties, real estate in Israel or abroad, loans/deposits, cash or cash equivalents).

- An intellectual property (IP) Box company operates under a special tax regime that encourages research and development by taxing patent revenue differently from other commercial revenue.

The primary condition to assess is whether the company in question is a CHC. If it is, other considerations, such as whether the CHC may be significant to the public interest (see also endnote 3), should be evaluated. Further, if the company is CHC, an impact assessment should be conducted at the level of each relevant CHC. Given that the assessment is conducted at the level of each individual company, there may be significant advantage to making dividend distributions between CHCs, considering potential merger opportunities, assessing intercompany charges and similar measures to mitigate the impact of the legislative change. ITO Section 62A - Taxation of ongoing profits Effective on 1 January 2025, ITO Section 62A has been materially expanded to introduce stricter taxation rules for any CHC that is not specifically excluded by the law.5 These changes are designed to address cases in which CHC profits originate from services provided by individual shareholders sourced by personal exertion,6 ensuring such income is taxed as personal earned income at individual rates. Key updates include reducing the evaluation period for determining service-based revenue, raising the threshold for officeholder exemptions, and introducing stricter rules for taxing excess profitability7 and intercompany dividends. These provisions aim to prevent the misuse of CHCs as vehicles to shield individual shareholders from a one level of taxation, thereby aligning corporate tax practices with individual tax obligations. Implications for non-Israeli shareholders: The provisions of ITO Section 62A are designed to tax Israeli individuals who are controlling shareholders8 of a CHC or any Israeli shareholder holding a role in a CHC whose efforts contribute to generating the CHC's turnover. Accordingly, the changes to this section likely have no direct implications for foreign tax residents. However, foreign shareholders might experience indirect impacts if the CHC is forced by Israeli individual shareholders to distribute dividends to cover the potential Israeli tax liability. In such cases, the consequences may include: - Israeli Withholding Tax: Forced dividend distributions could trigger withholding tax obligations under Israeli law.

- Foreign Income Tax: Shareholders may also incur income tax in their own jurisdictions on the distributed dividends.

- Cash Flow Implications: The company's available cash for ongoing operations may be reduced due to these distributions.

Taxpayers affected by these changes should ask their tax advisors for additional details on the new guidance and help navigating the process and implementation. | * * * * * * * * * * |

Endnotes1 A "company controlled by five persons or fewer" refers to a company in which five persons (i.e., individuals and/or corporations) or fewer, together, directly or indirectly control (i.e., above 50%) the company's affairs, have the ability to control, or are entitled to acquire control. 2 A "subsidiary" for the purposes of this section means a company whose shares, representing no less than 80% of its share capital, are held by a company or companies not regarded as CHC. 3 The term "significant public interest" is not explicitly defined in the law. However, in practice, the ITA has interpreted it to mean a public company with at least 25% of its shares held by the public. Nonetheless, the definition could be interpreted more broadly — for instance, to also include public company with less than 25% held by the public, private companies that have issued bonds to the public, among others. 4 Because the 2% tax rate and the 6% distribution rate are based on different base amounts, it makes sense to perform both calculations for each year to determine the most efficient approach. 5 ITO Section 62A excludes CFCs (Controlled Foreign Corporations), FICs (Foreign Investment Companies), and approved/preferred/industrial enterprises. In addition, the section also excludes CHCs with turnover exceeding 30 million New Israeli Shekel (NIS 30m) per controlling shareholder (including through a relative), or when the CHC's accumulated profits do not exceed NIS 750k at the level of the group of companies held by a controller shareholder. 6 Services provided by an individual who personally performs the work, such as professional services, teaching, creative work, manual labor etc. 7 Exceeding 25% of the CHC revenue for the current year will be viewed as subject to individual tax rates with respect to the controlling shareholder portion. 8 An individual who is an Israeli tax resident and holds, directly or indirectly, alone or together with others, at least 30% of any type of control in a CHC. | | * * * * * * * * * * | | Contact Information | For additional information concerning this Alert, please contact: EY Israel, Tel Aviv Ernst & Young LLP, Israel Tax Desk, New York | | Published by NTD’s Tax Technical Knowledge Services group; Carolyn Wright, legal editor |

Document ID: 2025-0364 |